Aims

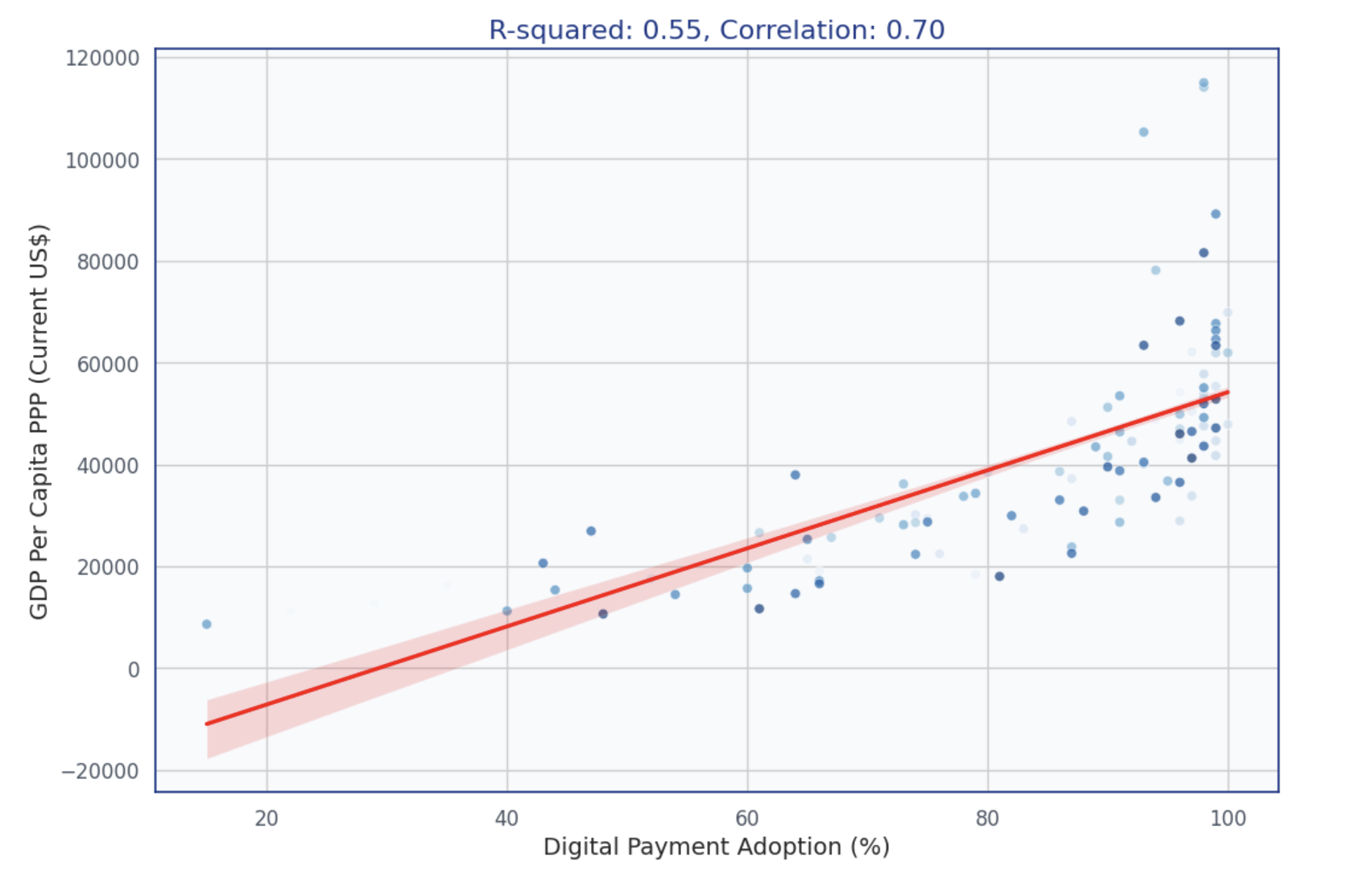

The project aims to evaluate the socioeconomic impact of Fintech in Europe, focusing on digital payments and financial inclusion. It seeks to identify relationships between Fintech investment, digital adoption, and economic indicators such as GDP PPP per capita. By creating a Fintech Inclusion Index and analysing user trends, the project addresses data limitations to uncover regional insights. The ultimate goal is to provide accessible, data-driven conclusions through carefully curated visualisations, offering meaningful perspectives on Fintech’s role in driving growth and inclusion.

Conclusions

The European fintech sector has shown remarkable growth, with digital payments projected to increase by 116% between 2018-2028. Digital payment adoption across Europe grew from 68.84% in 2014 to 85.63% in 2021. Despite this growth, the impact on income inequality appears modest, with the average GINI coefficient with a slight decrease prediction from 31.03 in 2018 to 30.43 in 2028. Traditional lending remains dominant, with peer-to-peer lending peaking at only 2.7% of total lending. While Fintech has transformed the financial landscape, its promise of significant socioeconomic impact remains partially fulfilled. The sector must focus on developing products that address disparities and expand services to underserved populations to truly democratise finance across Europe.

Moving forward, the European fintech sector must focus on:

1. Developing products that specifically address socioeconomic disparities within and between European countries.

2. Expanding services to underserved populations, particularly in Eastern and Southern Europe, to truly democratise finance across the continent.

3. Collaborating with EU and national policymakers to create an environment that fosters both innovation and social impact.

In conclusion, while fintech has made significant strides in transforming financial services across Europe, it has yet to fully deliver on its ambitious promise of widespread socioeconomic impact. The sector's potential remains vast, but realising it will require a concerted effort to align technological innovation with social progress, taking into account the diverse economic landscapes across European nations.

Challenges

Data availability and formatting posed significant challenges throughout the project. The World Bank Findex Database, updated only every three years, restricted timely analysis. Fintech investment data for Europe was sparse, covering only a few countries, which required using stock performance as a proxy (Visualisation 2). The absence of a standardised Fintech Inclusion Index necessitated computing one using six parameters from the Findex Database, dealing with inconsistencies such as binary (0/1) and multi-level formats (e.g., 1=yes, 2=no, 3=not sure) (Visualisation 4). Limited fintech user data from 2018–2028 led to the prediction of GNI using statistical methods to ensure sufficient data points for analysis (Visualisation 7). Missing values in many datasets were addressed through statistical imputation using averages (Visualisation 2). Furthermore, the lack of data on online banking fraud across Europe narrowed the analysis to the UK (Visualisation 5), restricting regional insights.

Data

The project relied on diverse data sources, including Statista, the World Bank Findex Database, the World Bank API, and the Yahoo API. World Bank sources required significant cleaning to ensure consistency and usability. Missing values were addressed using statistical imputation, with averages calculated to fill gaps, particularly in stock performance data (Visualisation 2). Fintech investment data was manually refined to exclude incomplete periods, such as H1 2024, where GDP PPP per capita data was unavailable (Visualisation 3).These efforts ensured that the data was as accurate and comprehensive as possible despite its initial limitations.

Data Processing

Data Processing